Кракен даркнет отзывы

Считаем своим долгом напомнить: продолжайте поддерживать местные независимые скейтпарки: в большинстве своем это действительно крутые и самобытные места, построенные скейтерами для скейтеров: без своих посетителей они просто не могут существовать долго. Но все же для нас главное, что данный масштабный проект включает в себя скейтпарк. Вход осуществляется только по предварительной записи. Подборка Обменников BetaChange (Telegram) Перейти. 64, 3 этаж, вход со двора. 10:51 СеверПост Новости, 10:51 СеверПост. Скейтпарк гзас в Нижнем Новгороде Нижний Новгород не так market давно уже успел блеснуть новым наикрутейшим скейтпарком «с оленями построенным на месте баске. Шлем не обязателен, но за дисциплиной в парке строго следят. С собой необходимо иметь сменную обувь, а вот наличие шлема, как в большинстве подобных мест, от вас никто требовать не будет. Кольский,. Он был создан при поддержке Региональной спортивной общественной организации экстремальных видов спорта Ставропольского края. Данная локация немного выбивается из общего ряда все же это не скейтпарк в прямом смысле этого слова. Скейтпарк «Калуга» Крытый скейтпарк в городе Калуга довольно просторный: его площадь составляет почти 1000 м2, причем здесь есть достаточное количество удобно расположенных фигур и ровный бетонный пол. Зои Космодемьянской,. Скейтпарк Sportex в Красноярске ЦЭС «Спортэкс» является уникальным проектом. Так что если вдруг у вас есть дети и волею судеб вы оказались в Мурманске вы знаете, что делать. Стоимость входа составляет от 500 рублей (количество проведенного в парке времени не ограничено). Для этой цели здесь даже были организованы тренировочные процессы по 16-ти дисциплинам. Клич Сыктывкар Работа парка осуществляется на общественных началах. Удобное расположение фигур сводит к минимуму непосредственное взаимодействие в парке приверженцев различных дисциплин, что, безусловно, не может не радовать. Стоимость посещения в будние дни: 200 рублей, в выходные: 300 рублей (цены указаны за 2 часа катания). Стоимость входа 150 рублей. Режим работы: в связи с тем, что вход возможен kraken только по предварительной записи, всегда по разному: следите на стене группы парка. Рампа находится в помещении проката-мастерской сноубордов и велосипедов «Detsusa». Так было с Логовом в Архангельске, импровизированным Роял-парком на парковке в Новосибирске, скейтпарком от ребят из Province на бывшей швейной фабрике в Барабинске, Притоном и Снейкпитом в Петербурге и многими другими. Болдина,. Вход обойдется в 300 рублей. Кроме стрит-секции, в скейтпарке есть небольшая минирампа с разгонкой. За весь день. По конфигурации скейтпарк функционально разделен на три зоны: специально оборудована флэт-зона для начинающих, есть полноценная стрит-секция, содержащая классический набор фигур, идеально подходящих для скейтбординга, и, наконец, эир-зона для любителей амплитуды и велосипедов. Большая Санкт-Петербургская,. Стоимость входа составит 200 рублей. «Штаб» расположен в березовом лесу напротив пруда у кафе «Угра». Свободное катание на весь день обойдется вам в 200 рублей. Будет установлен скейтпарк с Пяти Углов, будем кататься с 14:00-19:00. Хорошие качественные деревянные рампы, боул, наличие раздевалки и места для хранения инвентаря. Раньше в качестве альтернативы можно было воспользоваться минирампой в иркутском батутном центре с громким названием «Царский но к настоящему времени она уже демонтирована. К сожалению, выяснить доподлинно функционирует ли еще этот парк, нам не удалось, но судя по всему, его больше не существует. Адрес: Рязань, Яблочкова пр-д,. Если про что-то мы забыли или могли чего не учесть не обессудьте. Режим работы и стоимость входа: будут известны после реконструкции. Режим работы: с 12 до 21 ежедневно.

Кракен даркнет отзывы - Kraken market ссылка

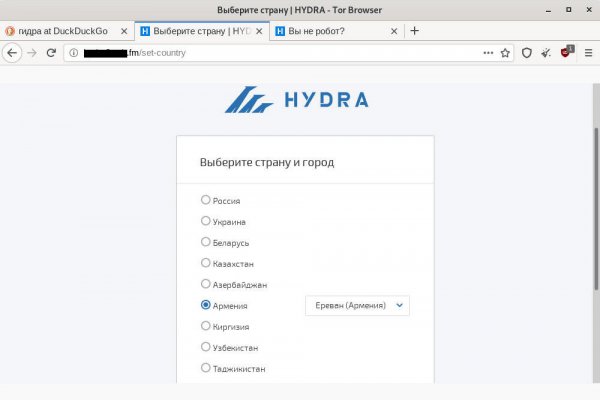

Располагается в темной части интернета, в сети Tor. Возможность создавать псевдонимы. Мега Даркнет не работает что делать? Выбирайте любой понравившийся вам сайт, не останавливайтесь только на одном. Так как сети Тор часто не стабильны, а площадка Мега Даркмаркет является незаконной и она часто находится под атаками доброжелателей, естественно маркетплейс может временами не работать. Onion - Архива. А ещё его можно купить за биткоины. Все первоначальные конфигурации настраиваются в автоматическом режиме). На Меге сотни тысяч зарегистрированных пользователей и понятное дело, что каждому не угодишь. И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. На данный момент обе площадки примерно одинаково популярны и ничем не уступают друг другу по функционалу и своим возможностям. Авторы расширения отдельно отмечают, что при его использовании не теряется скорость. Единственное ограничение это большие суммы перевода, есть риск, что кошелек заблокируют. Веб-сайты в Dark Web переходят с v2 на v3 Onion. . Онлайн системы платежей: Не работают! Hbooruahi4zr2h73.onion - Hiddenbooru Коллекция картинок по типу Danbooru. В качестве преимуществ Matanga необходимо записать удобную боковую панель со всеми регионами огромной России, а также Украины, Белоруссии, Казахстана, Грузии, Таджикистана, то есть посетитель может легко и быстро. Самое главное вы со своей стороны не забывайте о системе безопасности и отправляйте форму получения товара только после того как удостоверитесь в качестве. Итак, скачать Tor Browser Bundle проще всего с наших страниц. Площадка позволяет монетизировать основной ценностный актив XXI века значимую достоверную информацию. Русское сообщество. Подробнее можно прочитать на самом сайте. Opera, Mozilla и некоторых других. Первое из них это то, что официальный сайт абсолютно безопасный. Поисковики Настоятельно рекомендуется тщательно проверять ссылки, которые доступны в выдаче поисковой системы. Onion - Neboard имиджборд без капчи, вместо которой используется PoW. Предложение от конкурентов под названием hola! Yandex проиндексировал 5 страниц. Форум Меге это же отличное место находить общие знакомства в совместных интересах, заводить, может быть, какие-то деловые связи. Внимание!