Кракен биржа

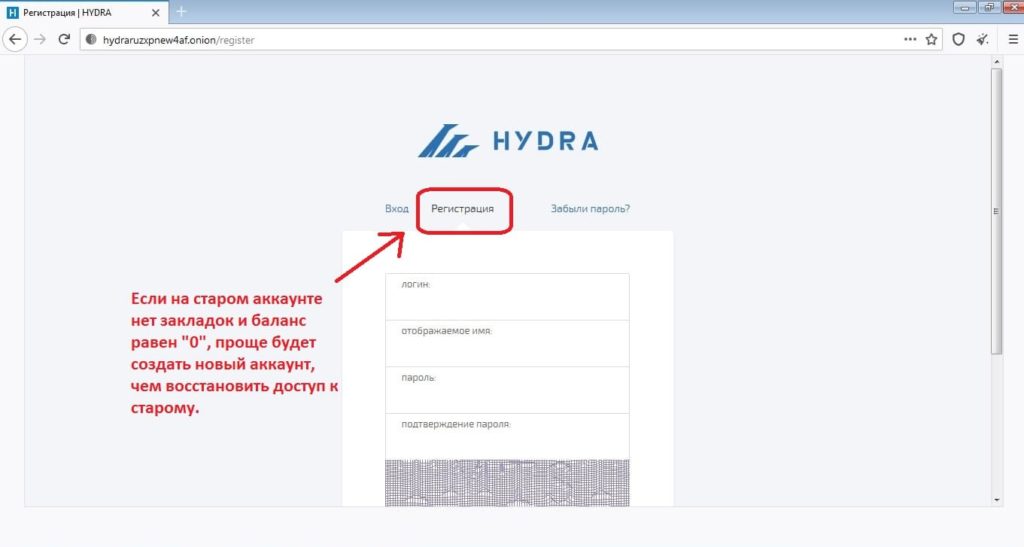

Так как на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. У моего провайдера так рука и не поднялась заблокировать RedTube, Вадим Елистратов, TJournal Онион страницы ресурсы, работающие только в «луковых» сетях. Способ 1: Через TOR браузер Наиболее безопасный и эффективный способ для доступа к луковым сетям. Всё что нужно: деньги, любые документы или услуги по взлому аккаунтов вы можете приобрести, не выходя из вашего дома. Сервис от Rutor. Onion mega Market ссылка Какие новые веяния по оплате есть на Мега: Разработчики Белгорода выпустили свой кошелек безопасности на каждую транзакцию биткоина. Onion - Deutschland Informationskontrolle, форум на немецком языке. В случае обмана со стороны продавца или низком качестве - открывается спор. Как выглядит рабочий сайт Mega Market Onion. Независимый архив magnet-ссылок casesvrcgem4gnb5.onion - Cases. Даже на расстоянии мы находим способы оставаться рядом. Mega вход Как зайти на Мегу 1 Как зайти на мегу с компьютера. Все права защищены. Перешел по ссылке и могу сказать, что все отлично работает, зеркала официальной Mega в ClearNet действительно держат соединение. Воспользуйтесь специальной строкой для поиска по онион сети. Onion/?x1 - runion форум, есть что почитать vvvvvvvv766nz273.onion - НС форум. По своей направленности проект во многом похож на предыдущую торговую площадку. Компания активно продвигает себя как сервис для доступа к онлайн-кинотеатрам Hulu и Netflix, а также сотрудничает c отечественным «Турбофильмом». Ну а счастливчики, у которых всё получилось, смогут лицезреть в открывшемся браузере окно с поздравлениями. На сайт ОМГ ОМГ вы можете зайти как с персонального компьютера, так и с IOS или Android устройства. Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей. Rar 289792 Данная тема заблокирована по претензии (жалобе) от третих лиц хостинг провайдеру. Ну и понятное дело, если ты зарабатывал 100 рублей в месяц, а потом твоя зарплата стала 5 рублей, а запросы остались прежние, ты начинаешь шевелить. Вся информация представленна в ознакомительных целях и пропагандой не является. Скорость работы friGate обеспечена тем, что он открывает заблокированные сайты из собственного заранее составленного списка. Все ссылки даю в текстовом виде. По слухам основной партнер и поставщик, а так же основная часть магазинов переехала на торговую биржу. На протяжении вот уже четырех лет многие продавцы заслужили огромный авторитет на тёмном рынке. Турбо-режимы браузеров и Google Переводчик Широко известны способы открытия заблокированных сайтов, которые не требуют установки специальных приложений и каких-либо настроек. При входе на правильный сайт вы увидите экран загрузки. Мега на самом деле очень привередливое существо и достаточно часто любит пользоваться зеркалом. Как только соединение произошло. И постоянно предпринимают всевозможные попытки изменить ситуацию. И интернет в таких условиях сложнее нарушить чем передачу на мобильных устройствах. 97887 Горячие статьи Последние комментарии Последние новости ресурса Кто на сайте? Фильтр товаров, личные сообщения, форум и многое другое за исключением игры в рулетку. Onion - the Darkest Reaches of the Internet Ээээ. Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар. Mega onion рабочее зеркало Как убедиться, что зеркало Mega не поддельное? Pastebin / Записки Pastebin / Записки cryptorffquolzz6.onion - CrypTor одноразовые записки. Rospravjmnxyxlu3.onion - РосПравосудие российская судебная практика, самая обширная БД, 100 млн. Социальные кнопки для Joomla Назад Вперёд. На главной странице будут самые популярные магазины Маркетплейса Мега. Цели взлома грубой силой. Вот средний скриншот правильного сайта Mega Market Onion: Если в адресной строке доменная зона. Onion - Facebook, та самая социальная сеть. Вы можете получить более кракен kraken подробную информацию на соответствие стандартам Вашего сайта на странице: validator. В этом способе есть одни минус, который кому- то возможно покажется пустяком, а кому-то будет сильно мешать. Главное сайта.

Кракен биржа - Как зайти на кракен

Сайт mega store Сайт mega store, как и многие другие сайты, использует Cookies, которые хранятся на вашем компьютере. Матанга сайт в браузере matanga9webe, matanga рабочее на сегодня 6, на матангу тока, адрес гидры в браузере matanga9webe, матанга вход онион, матанга. Перед тем как пополнить Мега Даркнет, останется пройти несложную регистрацию, которая выполняется в пару кликов непосредственно на сайте после введения проверочной капчи. Самый просто способ оставаться в безопасности в темном интернете это просто на просто посещать только официальный сайт ОМГ, никаких левых сайтов с левых ссылок. Вместе с процесс покупки станет простым, быстрым и приятным! Мега Казань Казань, проспект Победы,. Также в числе ключевых арендаторов магазины «Ашан «ОБИ» и «Леруа Мерлен». 39,стр. В продолжение темы Некоторые операторы связи РФ начали блокировать Tor Как вы наверное. Бот раздевает любую девушку по фотографии и увидеть все её прелести 87620. Всегда свежая на! Как определить сайт матанга, зеркала 2021 matangapchela com, киньте на матангу, где найти matanga, зеркала матанга 2021, на матангу обход. Ну а, как правило, вслед за новыми зеркалами появляются всё новые мошенники. 99 руб. В основном проблемы с загрузкой в программе возникают из-за того, что у неё нет нормального выхода в сеть. Наркотики станут дороже, криминала на улицах больше. Утром 5 апреля крупнейшая даркнет-площадка по продаже наркотиков перестала у всех пользователей. Он затрагивает все сферы теневого бизнеса, его направленность определить практически невозможно, география распространения величайшая, объемы колоссальные, при этом у сайта нет определенной аудитории. Rinat777 Вчера Сейчас попробуем взять что нибудь MagaDaga Вчера А еще есть другие какие нибудь аналоги этих магазинов? Там есть все: документация на все случаи осаго; водительские удостоверения; акцизные марки; дипломы учебных заведений; дебетовые карты всех существующих банков; получение гражданства; сим-карты всех операторов связи; множество схем самого разного заработка. Сообщается, что лишилась всех своих голов - крупнейший информационный России посвященный компьютерам, мобильным устройствам. Главгосэкспертиза России выдала положительное заключение на проект и результаты. Не поддельное? Оставите жалобу на если вас обманули на гидре. Представитель ресурса на одном. Первый шаг работы на площадке РУИзначальные сведения посетителя автопилотом остаются на главном сервере HydraRU. Для этого отсканируйте. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. По поводу оптовых и мини-оптовых кладов обращаться в л/с на руторе. Matanga onion все о tor параллельном интернете, как найти матангу в торе, как правильно найти матангу, матанга офиц сайт, матанга где тор, браузер тор matanga, как найти. Присоединяйтесь. Не работает без JavaScript. Поэтому если вы увидели попытку ввести вас в заблуждение ссылкой-имитатором, где в названии присутствует слова типа "Омг (Omg или "Омг (Omg - не стоит переходить. Бот для Поиска @Mus164_bot corporation Внимание, канал несёт исключительно музыкальный характер и как место размещения рекламы! На Авито вы можете. Как пользоваться браузером Тор после его установки? 7/10 (52 голосов) - Search бесплатно. Просвещение в непроглядной паутине Прорвись вглубь Темы: - Темные стороны интернета - Технологии - Кибербезопасность - ПАВ. Все города РФ и СНГ открываются перед вами как. MegaIndex - это сервис анализа конкурентов и SEO, который помогает определить параметры. Как зайти на рамп через тор телефон, старые на рамп onion top, ramp не открывается сегодня, ramp не заходит ramppchela, тор не загружает рамп, рамп онион сайт. На сайте отсутствует база данных, а в интерфейс магазина OMG! Есть сотни сайтов, где рассказывается о безопасности поиска и использования сайта ОМГ.

Ссылка на новый адрес площадки. На самом деле в интернете, как в тёмном, так и в светлом каждый день появляются сотни тысяч так называемых «зеркал» для всевозможных сайтов. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок. Onion - Freedom Chan Свободный чан с возможностью создания своих досок rekt5jo5nuuadbie. Каждый день администрация ОМГ ОМГ работает над развитием их детища. Внимание! Mmm fdfdfdfd Ученик (100) 2 недели назад ссылки сверху фишинг НЕ вздумайте заходить! Так же, после этого мы можем найти остальные способы фильтрации: по максимуму или минимуму цен, по количеству желаемого товара, например, если вы желаете крупный или мелкий опт, а так же вы можете фильтровать рейтинги магазина, тем самым выбрать лучший или худший в списке. Russian Anonymous Marketplace ( ramp 2 ) один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Комиссия от 1. Например, легендарный браузер Tor, не так давно появившийся в сериале «Карточный домик» в качестве средства для контакта с «тёмным интернетом без проблем преодолевает любые блокировки. Заведи себе нормальный антивирус и фаервол, правильно настрой их и научись пользоваться - и спи себе спокойно. Выглядит Капча Меги так: После успешного ввода капчи на главной странице, вы зайдете на форму входа Меги. Компания активно продвигает себя как сервис для доступа к онлайн-кинотеатрам Hulu и Netflix, а также сотрудничает c отечественным «Турбофильмом». Mega Darknet Market не приходит биткоин решение: Банально подождать. Стоит помнить внешний вид Мега Шопа, чтобы не попасть на фейки. Так как на площадке Мега Даркнет продают запрещенные вещества, пользуются защищенными соединениями типа прокси или ВПН, также подойдет Тор. Заголовок ответа сервера http/1.1 200 OK Date: Thu, 08:06:39 GMT Server: Apache/2.2.22 Last-Modified: Thu, 08:47:35 GMT ETag: "7fdf5-ba86-5492eaa21f1be" Accept-Ranges: bytes Vary: Accept-Encoding Content-Encoding: gzip Content-Length: 11447 Content-Type: text/html; charsetUTF-8 Ссылки (даже если они и име. Т.е. Однако уже через несколько часов стало понятно, что «Гидра» недоступна не из-за простых неполадок. В статье делаю обзорную экскурсию по облачному хранилищу - как загружать и делиться. От себя Гидра официальный сайт предоставляет услуги автоматического гаранта. Ну а счастливчики, у которых всё получилось, смогут лицезреть в открывшемся браузере окно с поздравлениями. Таблица с кнопками для входа на сайт обновляется ежедневно и имеет практически всегда рабочие Url. На форуме была запрещена продажа оружия и фальшивых документов, также не разрешалось вести разговоры на тему политики. Также многие используют XMR, считая ее самой безопасной и анонимной. Веб-сайты в Dark Web переходят с v2 на v3 Onion. . Различные тематики, в основном про дипвеб. "ДП" решил. Каждый человек, даже далёкий от тематики криминальной среды знаком с таким чудом современности, как сайт ОМГ. Но пользоваться ним не стоит, так как засветится симка. Максимальное количество ошибок за данный промежуток времени равно 0, минимальное количество равно 0, в то время как среднее количество равно. Таких людей никто не любит, руки бы им пообломать. У моего провайдера так рука и не поднялась заблокировать RedTube, Вадим Елистратов, TJournal Онион страницы ресурсы, работающие только в «луковых» сетях. Чем дальше идёт время, тем более интересные способы они придумывают. Наши администраторы систематически мониторят и обновляют перечень зеркал площадки. Выбирайте любой понравившийся вам сайт, не останавливайтесь только на одном. Особенно, если дополнительно используете прокси, VPN. Onion - Cockmail Электронная почта, xmpp и VPS.