Купить меф москва

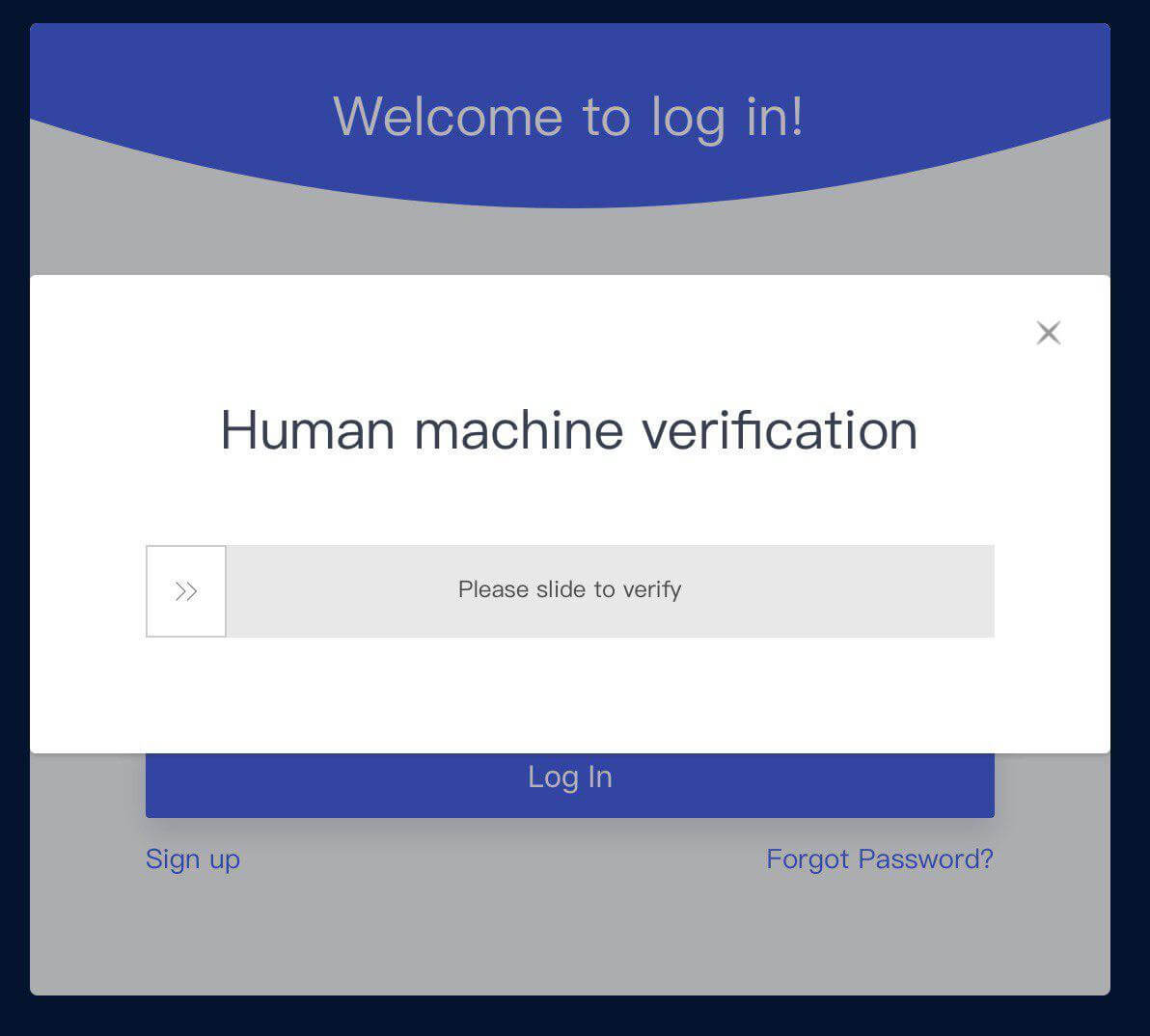

И если у тебя имеются несовершеннолетние дети, я рекомендую оградить их от Tor-а. Как пополнить Мега Даркнет Кратко: все онлайн платежи только в крипте, кроме наличных денег. В отсутствие какой-либо официальной информации даркнет принял решение игнорировать заявления Hellgirl, но держать их в уме. One TOR зеркало https monza73jr6otjiycgwqbym2qadw8il. Всё больше людей пытаются сохранить неприкосновенность своей частой жизни от длинного носа спецслужб. Дело в данном случае вполне богоугодное. Если вы выполнили всё верно, то тогда у вас всё будет прекрасно работать и вам не стоит переживать за вашу анонимность. Там же аккуратно добавляют. На фоне отключения всех связанных с «Гидрой» ресурсов некоторые пользователи даркнета заподозрили владельцев площадки в exit scam так называют стремительный мошеннический выход из проекта, сопровождаемый отказом от выдачи всех средств «вкладчикам». Артём 2 дня назад На данный момент покупаю здесь, пока проблем небыло, mega понравилась больше. Для того чтобы купить товар, нужно зайти на Omg через браузер Tor по onion kraken зеркалу, затем пройти регистрацию и пополнить свой Bitcoin кошелёк. Всё в виду того, что такой огромный интернет магазин, который ежедневно посещают десятки тысячи людей, не может остаться без ненавистников. И все же лидирует по анонимности киви кошелек, его можно даркнет оформить на левый кошелек и дроп. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Это больная тема в тёмном бизнесе. Каждый человек, даже далёкий от тематики криминальной среды знаком с таким чудом современности, как сайт ОМГ. Вы можете загрузить свои логотипы и фотографии, подписаться на новости компании, отсортировать фото для сортировки по дате или по популярности, и загрузить все это в корзину. Статья 222 УК РФ штраф до 200 тыс. Она считалась крупнейшим маркетплейсом даркнета: в 2021 году на ее долю приходилось 80 от всей общемировой выручки даркнет-маркетов, по данным отчета Chainalysis. Чтобы каждый раз не бродить по жёсткому диску, можно кинуть линк (ссылку/ярлык) на этот файл в любое удобное место, например, на тот же Рабочий стол или на панель Windows. Проект существовал с 2012 по 2017 годы. Ресурс был доступен через сеть Tor, по меньшей мере, с 2015. Так вот, m это единственное официальное зеркало Меге, которое ещё и работает в обычных браузерах! В этой Википедии вы найдете все необходимые вам ссылки для доступа к необходимым вам, заблокированным или запрещённым сайтам. Клубы по интересам, блоги, форум. Поэтому ты вполне можешь наткнуться на вещи, которые тебя шокируют. Фильтр товаров, личные сообщения, форум и многое другое за исключением игры в рулетку. Дальше сам. В., Хабибулин. И тут на помощь им приходит анонимная сеть Tor. Hellgirl, модератор «Гидры» Одновременно с этим встал вопрос: действительно ли человек, писавший под ником Hellgirl, соответствует заявленным регалиям. Причём, администрация App Store извещалась об этом неоднократно ещё осенью. Пачки законов, «из самых лучших побуждений» штампуемые думами, радами и парламентами, всё резче определяют границы резерваций, в рамках которых теперь только и возможно существование пользователей в глобальной Сети.

Купить меф москва - Kraken ссылка зеркало официальный

ервов, всё время во всех городах доступно любое желаемое вещество. Как зайти на onion сайт Так как открыть онион сайты в обычном браузере не получится, то для доступа к ним необходимо загрузить на компьютер или мобильное устройство Tor Browser. Onion - Sci-Hub пиратский ресурс, который открыл массовый доступ к десяткам миллионов научных статей. ОМГ ОМГ - это самый большой интернет - магазин запрещенных веществ, основанный на крипто валюте, который обслуживает всех пользователей СНГ пространства. Onion - torlinks, модерируемый каталог.onion-ссылок. Расследование против «Гидры» длилось с августа 2021. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Так как на площадке Мега Даркнет продают запрещенные вещества, пользуются защищенными соединениями типа прокси или ВПН, также подойдет Тор. Основателем форума являлся пользователь под псевдонимом Darkside. 1566868 Tor поисковик, поиск в сети Tor, как найти нужный.onion сайт? Sblib3fk2gryb46d.onion - Словесный богатырь, книги. Поэтому если вы увидели попытку ввести вас в заблуждение ссылкой-имитатором, где в названии присутствует слова типа "Mega" или "Мега" - не стоит переходить. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. На Hydra велась торговля наркотиками, поддельными документами, базами с утечками данных и другими нелегальными товарами. Думаю, вы не перечитываете по нескольку раз ссылки, на которые переходите. Магазин предлагает несколько способов подачи своего товара. Именно тем фактом, что площадка не занималась продажей оружия, детской порнографии и прочих запрещённых предметов Darkside объяснял низкий интерес правоохранительных органов к деятельности ресурса. Отойдя от темы форума, перейдем к схожей, но не менее важной теме, теме отзывов. Желающие прочесть его смогут для этого ввести твой публичный ключ, и сервис выдаст текст. Onion - GoDaddy хостинг сервис с удобной админкой и покупка доменов.onion sectum2xsx4y6z66.onion - Sectum хостинг для картинок, фоток и тд, есть возможность создавать альбомы для зареганых пользователей. Mega вход Как зайти на Мегу 1 Как зайти на мегу с компьютера. Цели взлома грубой силой. Список ссылок обновляется раз в 24 часа. На нашем сайте представлена различная информация о сайте.ru, собранная из открытых источников, которая может быть полезна при анализе и исследовании сайта. Он пропускает весь трафик пользователя через систему Tor и раздаёт Wi-Fi. Всё что нужно: деньги, любые документы или услуги по взлому аккаунтов вы можете приобрести, не выходя из вашего дома. Onion заходить через тор. Onion - Fresh Onions, робот-проверяльщик и собиратель.onion-сайтов. До этого на одни фэйки натыкался, невозможно ссылку найти было. Он действительно работает «из коробки» и открывает страницы, заблокированные любым известным способом, оповещая пользователя о входе на «запретную территорию» одним лишь изменением иконки на панели управления. Первое из них это то, что официальный сайт абсолютно безопасный. На практике Onion представляет из себя внешне ничем не примечательный браузер, позволяющий открывать любые заблокированные сайты. Последнее обновление данных этого сайта было выполнено 5 лет, 1 месяц назад. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Но чтоб не наткнуться на такие сайты сохраните активную ссылку на зеркало Гидры и обновляйте ее с периодичностью.

Добро пожаловать, если вы искали официальную ссылку ГИДРА, вы в нужном месте. ОМГ - это один из самых крупных магазинов запрещенных веществ и различных услуг в России и СНГ.Рейтинг биткоин миксеров Топ 10 миксеры криптовалютыНа данной странице вы найдете ссылки и зеркала гидры, а также узнаете как зайти на гидру через Tor

или обычный браузер.ОМГ сайт - общая информация о гидре, а также ссылка на гидру.Прежде чем начать, хотелось бы вам напомнить что сейчас очень много различных фейков и мошенников связанных с нашим сайтом, поэтому мы рекомендуем вам добавить эти статьи в избранные, это официальные статьи гидры в которых вы сможете узнать обо всем что вас интересует по сайту омг.ОМГ (омг официальный, омг сайт, омг ссылка, омг онион) это огромный магазин различных нелегальных услуг и наркотических веществ по России и СНГ. Сегодня омг сайт в подавляющем большинстве ориентированно больше на клиентов из РФ. ОМГ (омг официальная) работает круглосуточно, также постоянно магазины на гидре пополняют свой ассортимент, в большом количестве городов уже сейчас доступен немалый выбор разновидностей веществ для продажи. Также на гидре присутствуют продавцы, которые предоставляют нелегальные услуги, например: вы можете пробить любой мобильный номер телефона, также заказать взлом почты или социальных сетей, для сам изготовят различные поддельные документы, на омг можно заказать зеркальные права. Главная цель омг маркет - это естественно продажа различных наркотиков. На официальной гидре, вам предоставляется возможность приобрести такие товары как: экстази (как колеса, так и кристаллы MDMA и MDA), марихуана (гашиш, бошки, трава), кокаин, марки (LSD и другие), грибы, спайсы, героин, скорость, регу и так далее.При покупке чего-либо на сайте омг, у вас есть возможность выбрать район города в котором будет закладка, а также мы вам рекомендуем прочесть отзывы других покупателей товаре и его качестве, также там описана работа курьера и т.д. Также на омг онион есть своя служба проверки качества продаваемых веществ, которая периодически анонимно приобретает у случайно выбраных продавцов товар и проводит их анализ, если продавец обманул или продавал не то вещество, а также если качество товара не соответствует указанному на ветрине, то такой магазин попросту блокируют. На омг сайт маркете работает 24/7 техподдержка которая помогает решать все возможные возникающие вопросы, в любое время суток вы можете рассчитывать на техподдержку, при любых непонятных или возникающих вопросов. Не спешите впадать в крайности и грубить продавцам в случае недоговорённости, вы всегда можете написать в нашу техподдержку и описать всю сложившуюся ситуацию, вам обязательно помогутНа сайте всегда активен автогарант, продавец получает деньги только когда клиент подтвердит, что он "забрал" закладку. В случае ненахода у вас есть возможность открыть диспут и написать о возникшей проблеме, продавец в процессе диалога и его итоге должен сделать перезаклад или вернут вам ваши средства за покупку, если у вас с продавцом не получается прийти в всеобщему решению, то вы можете пригласить модератора сайта омг, который третьм лицом, взглядом со стороны сможет решит ваш конфликт, модератор не заинтересован в поддержке продавца, скорее наоборот он будет всячески вам помогать, поэтому вам не стоит бояться и всегда обращайтесь к модераторам по различным вопросам. Все покупки работают автономно, вам не нужно ожидать продавца пока он будет в сети, все что необходимо для совершения покупки - это пополнить свой личный баланс биткоин (очень подробно об этом вы описали ранее в своей статье этой странице). Также, у вас есть такая возможность как сделать предзаказ, много магазинов предоставляют такую возможность, это когда вы договариваетесь с продавцом на нужный вам товар и количество, оплачиваете и продавец собирает заказ, после чего курьер делает закладку и вам присылает вам адрес, часто по предзаказу продавцы обращают внимание на ваши пожелания по району, в котором будет закладка, все это можно найти по ссылке на гидру. Также автогарант действует при осуществлении покупки по предзаказу, поэтому вам не о чем беспокоиться, деньги продавец получает только после подтверждения вами "находа".Написанные ранее статьи и советы по сайту омг, указаны по этой ссылке статьи сайта омг, а также зеркалом omg: Мы рекомендуем каждый раз пере приобретением товара прочесть отзывы о нем, из них вы почти всегда узнаете о качестве товара и качестве закладки. Всегда подтверждайте наход и оставляйте отзыв, это поможет вам сберечь ваши деньги в случае ненахода и поможет другим покупателям определиться с товаром. При регистрации никогда не используйте логин или никнейм который вы используете социальных сетях или различных онлайн играх, не привлекайте к себе внимание - ваша безопасность превыше всего

Теги:омг, омг официальная, омг зеркала, омг онион, омг ссылка, как зайти на гидру, ссылка на гидру, omg, omg onionЗеркала на ГидруДля того чтобы сохранить ваше время и деньги, мы выложили для вас списки официальных ссылок на гидру. Сегодня в интернете много различных фейковых сайтов по магазину ОМГ, поэтому мы хотим чтобы вы переходили только по официальным ссылкам и зеркалам ОМГ, добавьте эти ссылки себе в закладки.

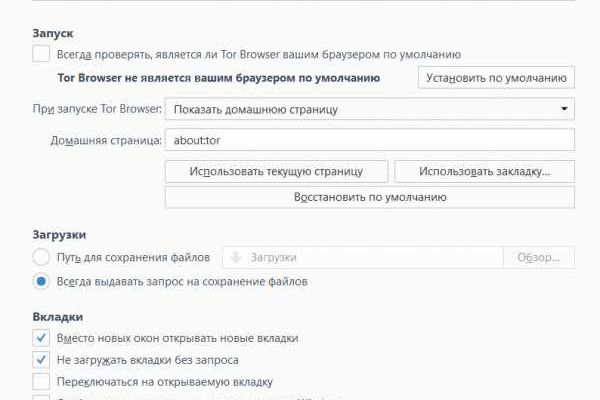

Более подробно о фейках и мошенниках вы сможете узнать по статье на сайте омг (ссылка на статью), пользуйтесь только проверенными зеркалами магазина омг.Как зайти на омг сайт через Tor браузерДля того чтобы зайти на омг сайт по ссылке в тор сначала нужно скачать Tor браузер. Для того чтобы скачать этот браузер перейдите по ссылке на официальный сайт - Tor project. Мы вам рекомендуем пользоваться Тор браузером для совершения покупок на омг магазин, потому-что это наверное самый безопасный способ осуществления покупки в криптомагазине омг, потому что в нем есть встроенный и постоянно активный VPN, это сохранит вашу анонимность в сети, используя Tor вы обезопасите в первую очередь себя.Для работы омг сайта необходимо использовать браузер Тор. Но кроме того, нужно зайти на правильный сайт, не попав на мошенников, которых достаточно много. Потому, для вас эта ссылка на омг сайт. Таким образом вы будете уверены что находитесь на официальном сайте омг. Также, мы рекомендуем вам использовать дополнительные программы как: VPN, прокси и другое.Как зарегистрироваться в магазине наркотиков омг сайт (omg,omg ссылка,omg онион).Чтобы зарегистрироваться на сайте ОМГ, вам необходимо пройти короткую регистрацию, попасть туда вы можете нажав в правом верхнем углу на кнопку "Регистрация", далее вы попадете на страницу регистрации там будет несколько колонок.

Для того чтобы создать аккаунт на гидре, вам нужно придумать свой "логин" который будет использоваться для того чтобы зайти на сайт гидры, "отображаемое имя на сайте" должно отличаться от логина. Для вашей же безопасности мы рекомендуем вам устанавливать как можно сложный пароль, и не при каких-либо обстаятельствах не сообщаейте его никому, даже администрации Гидры, никто не вправе знать ваш пароль, кроме вас самих. После того как вы введете ваши данные и пройдете captcha, вам нужно принять правила пользования на сайте омг и на этом ваша регистрация окончена, можно приступить к пополнению баланса и покупке наркотиков. Подробнее о выборе и перемещении по сайту вы можете узнать по нашей статьеТакже, как пополнить свой личный счет и сделать первую покупку вы сможете узнать в наших статьях, которые мы подготовили заранее специально для вас, по этой ссылке вы сможете найти статью на любой интересующий вас вопрос. Планируется дальнейшие публикации статей для вас, на основе ваших же вопросов администрации сайта ОМГ, будет составлен список, градацией количеством ваших запросов, мы заботимся о вашем комфортном нахождении в магазине гидры. К тому же мы периодически публикуем различные новости связанные с сайтом гидры и не только.

На сайте гидры есть наркологическая служба, с которой вы можете посоветоваться и задать интересующие вас вопросы, вам всегда ответят и помогут, вы можете положиться на наших специалистов.