Купить закладку бошки

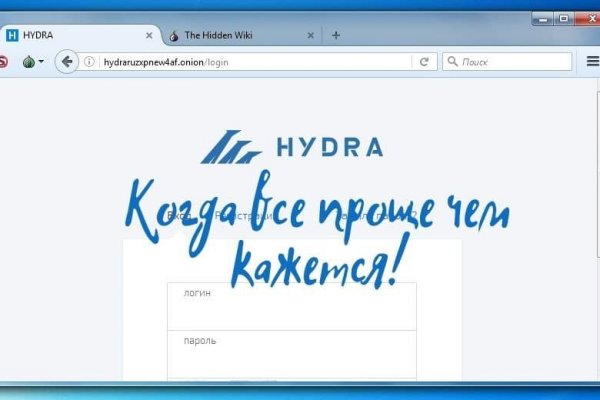

Речь идёт о крупнейшей площадке для это торговли наркотиками и крадеными данными. Onion - Sigaint почтовый сервис, 50 мб бесплатно, веб-версия почты. Языке, покрывает множество стран и представлен широкий спектр товаров (в основном вещества). Может слать письма как в TOR, так и в клирнет. На данный момент Гидра com является самым удобным и приятным криптомаркетом всей онион сети интернет. А ещё его можно купить за биткоины. Многие из них не так эффективны, как хотелось. И постоянно предпринимают всевозможные попытки изменить ситуацию. Что можно купить на Гидре Если кратко всевозможные запрещенные товары. Одним из самых главных способов обхода страшной блокировки на сайте Меге это простое зеркало. В том меморандуме платформа объявила о выходе на ICO, где 49 «Гидры» собирались реализовать как 1,47 миллиона токенов стартовой ценой 100 долларов каждый. Гарантия возврата! Безусловно, главным фактором является то, что содержание сайта должно быть уникальными и интересным для пользователей, однако, Вы можете узнать что то новое из опыта других. Залетайте пацаны, проверено! Способ 1: Через TOR браузер Наиболее безопасный и эффективный способ для доступа к луковым сетям. Нужно знать работает ли сайт. Данный сервер управляется панелью управления BrainyCP. Хорошая новость, для любых транзакций имеется встроенное 7dxhash шифрование, его нельзя перехватить по воздуху, поймать через wifi или Ethernet. В платных аках получше. Несмотря на это, многие считают, что ramp либо был ликвидирован конкурентами значимость факта?, либо закрыт новыми администраторами значимость факта? Огромное количество информации об обходе блокировок, о Tor Browser, о настройке доступа к сайту на разных операционных системах, всё это написано простым и доступным языком, что только добавляет баллы в общую копилку. Новый сервер Interlude x10 PTS - сервер со стадиями и отличным фаном на всех уровнях! Он годится как закрытый инструмент, не влияющий на работу остальной системы. Onion - простенький Jabber сервер в торе. Это больная тема в тёмном бизнесе. Она специализировалась на продаже наркотиков и другого криминала. Searchl57jlgob74.onion/ - Fess, поисковик по даркнету. Установите Тор в любую папку на компьютере или съемном USB носителе. Воспользуйтесь специальной строкой для поиска по онион сети. Социальные кнопки для Joomla Назад Вперёд.

Купить закладку бошки - Кракен площадка нарко

В июле этого года МВД России ликвидировало крупнейший интернет-магазин. 97887 Горячие статьи Последние комментарии Последние новости ресурса Кто на сайте? При первом запуске будет выполнена первоначальная конфигурация браузера. Именно на форуме каждый участник имеет непосредственную возможность поучаствовать в формировании самого большого темного рынка СНГ Hydra. If you have Telegram, you can view and join Найдено в даркнете right away. После осуществления регистрации для большей анонимности сайт работает на оплате двумя способами - это киви и криптовалюта. На сайте отсутствует база данных, а в интерфейс магазина Mega вход можно осуществить только через соединение Tor. Обратные ссылки являются одним из важнейших факторов, влияющих на популярность сайта и его место в результатах поисковых систем. Либо воспользоваться специальным онлайн-сервисом. Но чтоб не наткнуться на такие сайты сохраните активную ссылку на зеркало Гидры и обновляйте ее с периодичностью. Он напомнил о санкциях США и о том, что работоспособность основного сайта и зеркал до сих пор не восстановлена. Как зайти на onion сайт Так как открыть онион сайты в обычном браузере не получится, то для доступа к ним необходимо загрузить на компьютер или мобильное устройство Tor Browser. Требуется регистрация, форум простенький, ненагруженный и более-менее удобный. Onion - Продажа сайтов и обменников в TOR Изготовление и продажа сайтов и обменников в сети TOR. Главное зеркало: mega555kf7lsmb54yd6etzginolhxxi4ytdoma2rf77ngq55fhfcnyid. Особенно хочу обратить ваше внимание на количество сделок совершенное продавцом. Onion - SleepWalker, автоматическая продажа различных виртуальных товаров, обменник (сомнительный ресурс, хотя кто знает). Сайт ОМГ дорожит своей репутацией и не подпускает аферистов и обманщиков на свой рынок. Почему именно mega darknet market? Начинание анончика, пожелаем ему всяческой удачи. Он несколько замедляет работу браузера, обещая при этом «бесплатное полное шифрование трафика а для его активации требуется ввести адрес электронной почты. Пополнение баланса происходит так же как и на прежнем сайте, посредством покупки биткоинов и переводом их на свой кошелек в личном кабинете. Всяческие политико-революционно-партизанские ресурсы здесь не привожу намеренно. На Меге сотни тысяч зарегистрированных пользователей и понятное дело, что каждому не угодишь. Годнотаба - список ссылок с onion зоны. Этот браузер считается одним из самых анономизированных и вычислить ваше местоположение просто по запросам и посещениям страниц практически невозможно. Оригинальное название mega, ошибочно называют: mego, мего, меджа, union. Onion - Alphabay Market зарубежная площадка по продаже, оружия, фальшивых денег и документов, акков от порносайтов. Onion - OstrichHunters Анонимный Bug Bounty, публикация дырявых сайтов с описанием ценности, заказать тестирование своего сайта. Интернету это пойдёт только на пользу. Onion - OutLaw зарубежная торговая площадка, есть multisig, миксер для btc, pgp-login и тд, давненько видел её, значит уже достаточно старенькая площадка. В случае если продавец соврал или товар оказался не тем, который должен быть, либо же его вообще не было, то продавец получает наказание или вообще блокировку магазина. Как зайти 2021. Всем мир! Из-за этого в 2019 году на платформе было зарегистрировано.5 миллиона новых аккаунтов.

Годнотаба - список ссылок с onion зоны. В июле этого года МВД России ликвидировало крупнейший интернет-магазин. Org так и не открылись. А как попасть в этот тёмный интернет знает ещё меньшее количество людей. Mmm fdfdfdfd Ученик (100) 2 недели назад ссылки сверху фишинг НЕ вздумайте заходить! Mega Darknet Market не приходит биткоин решение: Банально подождать. Qubesos4rrrrz6n4.onion - QubesOS,.onion-зеркало проекта QubesOS. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. По словам Артёма Путинцева, ситуация с Hydra двойственная. Есть интересное содержание? Как зарегистрироваться на Mega? Сообщения, анонимные ящики (коммуникации). 1566868 Tor поисковик, поиск в сети Tor, как найти нужный.onion сайт? Onion/rc/ - RiseUp Email Service почтовый сервис от известного и авторитетного райзапа lelantoss7bcnwbv. Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20 Audiodateien Alle 20 Audiodateien anzeigen 249 Personen gefällt das Geteilte Kopien anzeigen Двое этих парней с района уже второй месяц держатся в "Пацанском плейлисте" на Яндекс Музыке. Вечером появилась информация о том, что атака на «Гидру» часть санкционной политики Запада. Небольшой список.onion сайтов в сети Tor. Он отличается простотой в использовании не добавляет собственную рекламу. Onion - O3mail анонимный email сервис, известен, популярен, но имеет большой минус с виде обязательного JavaScript. Различные тематики, в основном про дипвеб. Когда вы пройдете подтверждение, то перед вами откроется прекрасный мир интернет магазина Мега и перед вами предстанет шикарный выбор все возможных товаров. Проект создан при поддержке форума RuTor.