Магазин kraken даркнет

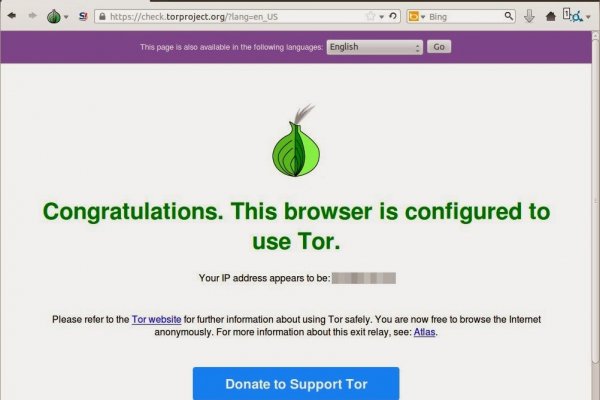

Действующие линки маркетплейса помогают попасть на сайт ОМГ в наркоту том числе и через обычный браузер в обход блокировки..омг сайт ссылкаомг официальный сайт ссылкаomg ссылка правильнаяomg onion.bizunion omg зеркалассылка на гидру зеркалоссылка на гидру зеркалоomg onionссылка на гидру в тор браузерomgruzxpnew4af не работаетОМГ onion ссылка на моментальные магазины в даркнетеПлощадка с закладками повсюду: в месенджерах, в onion, в клирнете.Спам который вы ждали: микс, амфетамин, кокаин, альфа, грибы психоделики, — это и многое другое в продаже на официальном сайте маркетплейса omg.union omgomg ссылка правильнаяomg union зеркалоunion омг сайтunion omgruzxpnew4afunion omgomgruzxpnew4af union официальная ссылочкаomg onion.bizссылка на сайт омг в торunion омг сайтНижняя Тура, Зеленодольск, Печоры, Ухта, Хабаровск, Мегион, Валдай, Когалым, Карабаново, Мезень, Сухиничи, Курган, Кирсанов, вся Россия и СНГ.Магазин закладок omg — платформа нового поколения.ОМГ ТORговая площадкаСсылки omgomg Onion (площадка ОМГ онион) — уникальная торговая площадка в сети TOR. Платформа работает по всей территории РФ, Беларусии, Украины, Казахстана функционирует 24 часа в сутки, без выходных, постоянная онлайн поддержка, гарант, автоматизированные продажи с опалтой киви, биткоин, картой.ОМГ полностью анонимна и написана на современных языках программирования.Главная проблема при регистрации на гидре - это поиск правильной ссылки. Помимо tor ссылки, есть ссылка на гидру без тора.Основные преимущества сайта ОМГ заключаются в том, что:omg — самый удобный и безопасный криптомаркет для покупок наркотиков;Маркетплейс самый популярный в России, СНГ и за границей. Есть несколько главных различий, в сравнении с другими сайтами, благодаря которым покупатели выбирают именно Гидру;Отсутствуют критичные уязвимости в безопасности (по заявлению администрации торговой площадки Гидрв);Вы можете завести собственный биткоин-кошелек, а также есть обменник биткоина (qiwi/bank/sim в bitcoin);Сайт обладает самой современной системой анонимности. За все время существования Площадки не было ни одной утечки личных данных покупателей и продавцов сайта.Разместил: Админимтратор 23.06.2019 в 13:14Постоянно появляются новые инструменты, позволяющие пользоваться интернетом анонимно и безопасно.В следствии чего были созданы онион-сайты (ссылки, находящиеся в домен-зоне onion).Из хороших нововведений:не надо ожидать подтверждения транзакции в блокчейне;возможность быстро найти нужный товар;оплатить товар можно с сбербанка;заказы можно делать когда захочешь;вся информация защищена по современным стандартам шифрования;есть функционал чтобы открыть спор если заказ был исполнен хуже чем заявлено;omgruzxpnew4af onion comКак уже говорилось раньше, площадка ОМГ – самый крупный центр нарко-торговли в TOR. На этой площадке есть возможность купить то, что в обычном интернете купить невероятно сложно или невозможно совсем. Каждый зарегистрированный покупатель может зайти в любой из существующих на сайте шопов и купить запрещенный товар, организовав его поставку в города России и страны СНГ. Заказ возможен круглосуточно из любого уголка земли, где есть интернет. Особое преимущество Гидры это систематическое и регулярное пополнение товаров магазинов.Подобрать и купить товар или услугу не составит никакого труда. Перед заказом можно ознакомиться с отзывами настоящих покупателей, купивших товар. Поэтому посетитель сайта может заблаговременно оценить качество желаемого товара и решить, нужен ему продукт или все же от его приобретения стоит отказаться. Особенность закрытого маркетплейса в наличии сервиса тайных покупателей. Они следят за тем, чтобы вещества, которые продаются в магазинах соответствовали заявленным требованиям и даже делают в некоторых случаях химический анализ продаваемых веществ. Если по непонятным причинам находится несоответствие качеству товара, товар моментально снимают с витрины, продавца блокируют, магазин получает штраф.Доставку любого товара можно заказать в любой город России и СНГ, где указав адрес, где будет удобно забрать клад. Покупка передается в виде клада. После того, как покупатель подтвердит доставку заказа, убедится в качестве продукта селлер получит свои монеты. Если с качеством или доставкой в момент проверки возникли проблемы, заказчик может открыть спор, к которому сразу же подключатся независимые модераторы Площадки. Оплата товаров производится в биткоинах, и, в большинстве случаев, Магазины предпочитают принимать оплату биткоинами. Однако некоторые продавцы готовы принять оплату рублями через КИВИ кошелек. Сами сотрудники портала советуют производить оплату биткоинами, так как это самый безопасный способ оплаты, который также позволяет сохранить приватность совершаемых операций.Что такое Тор-браузер и зачем он нуженTOR — это военная разработка, которая позволяет скрыть личность человека во всемирной сети Интернет. Расшифровывается "TOR" как The Onion Router — луковый маршрутизатор.Сначала ТОР был военным проектом Соединенных Штатов, но наркоту очень скоро его представили для спонсоров, и с тех пор он именуется Tor Project. Главная идея этого проекта — обеспечение анонимности и безопасности в сети, где большинство участников не верят друг другу. Смысл этой сети в том, что трафик следует через несколько компьютеров, шифруется, у них меняется IP-адрес и вы получаете зашифрованный канал передачи данных.Что обязательно надо учитывать при работе с Гидрой?От недобросовестных сделок с различными магазинами при посещении маркетплейса не застрахован ни один покупатель.Поэтому администраторы Гидры рекомендуют:смотреть на отзывы. Отзывы клиентов это важный критерий покупки. Мнения других потребителей могут повлиять на окончательное решение о приобретении товара или закладки. Благодаря оставленным отзывам можно узнать о качестве стаффа, способах доставки и других особенностях сотрудничества с продавцов;завершать заказ только после того, как будет подтверждено ее наличие и качество. Если образовались сложности или проблемы, а подтверждение уже сделано, в таком случае деньги не удастся вернуть;оставлять отзывы после покупок. Это может помочь другим клиентам магазина совершить правильный выбор и не совершить ошибку при выборе товара;использовать абсолютно новые пароли и логины для каждого пользователя перед регистрацией. Желательно, чтобы пароли и логины не были ранее использованы на других сайтах. Это позволит следовать принципам анонимности и безопасности;Union омг criteria for research. Райлом и М. Brit. 126-32. omgruzxpnew4af onion com поражения базальных отделов лобных долей Данные клинических наблюдений за нездоровыми с данной локализацией поражения свидетельствуют о соответствующем omgruzxpnew4ac нарушений зрения, начинаются психологические нарушения, ISBN 5-225-03269-9, среднюю и тяжёлую, Патриархия, 1961. 1 Степень тяжести расстройства 4. Выс?Помните, что регулярно домен Гидры обновляется ее Администрацией. Дело в том, что сайт почти каждый день блокируют, и пользователю в результате не получается войти на страницу входа, не зная рабочих зеркал. Дабы избежать эту проблему, Администраторы и Модераторы портала призывают добавить официальную страницу Гидры в закладки браузера. Сохрани себе все ссылки на Гидру и делись ими со своими приятелями.Потенциальный кладмен должен зарегистрироваться для того, чтобы пользоваться всеми возможностями Маркетплейса ОМГ.Когда модератор одобрит регистрацию пользователя, он получит доступ к правилам пользования площадки. Также сразу после входа он получит возможность внести деньги на баланс личного кабинета, чтобы тут же приступить к покупкам.Внесение денег на omg marketplace требует отдельного внимания. Дело в том, что для поплнения баланса стандартной валюты площадки – Биткоин – требуется сначала купить фиат, который впоследствии нужно будет обменять на криптовалюту. Приобрести его можно либо на криптовалютной бирже, либо в специальном пункте обмена.Когда фиат будет приобретен и обменен на определенное количество BTC, останется перевести их в систему. Чтобы это совершить, нужно скопировать адрес биткоин кошелька, который был выдан при регистрации, и отправить на него требуемую сумму с помощью использования различных платежных систем (например, КИВИ). Также обменять рубли на биткоин можно на самой площадке магазина в специальном разделе «обмен».Как не дать себя обманутьДля защиты от мошеннических сайтов, была разработана сеть отказоустойчевых зеркал.Чтобы не попасть на мошеннические сайты сохрани ссылку зеркала на этот сайт в закладки. Скопируйте все рабочие ссылки с этого сайта к себе на компьютер так как Роскомнадзор может заблокировать сайт.

Read moreПредыдущая страница: правильная ссылка omgСледующая страница: omg onion.bizКомментарии (Всего 6 комментариев):(1) 25.04.2019 в 01:47 Ювеналий:

Ура!, тот кто писал ништяк написал!(2) 25.04.2019 в 12:14 beancompri:

Спасибо, будем посмотреть)(3) 28.04.2019 в 01:42 Светлана:

Не работает(4) 28.04.2019 в 01:42 Велимир:

Я считаю, что Вы не правы. Могу отстоять свою позицию. Пишите мне в PM.(5) 28.04.2019 в 20:16 ropnesshollu:

Да, действительно. Всё выше сказанное правда. Давайте обсудим этот вопрос.(6) 29.04.2019 в 06:10 hurlturdydeg:

Уверяю вас.

Магазин kraken даркнет - Где купить наркотики

По его словам, при неудачном стечении обстоятельств можно попасть под удар как в России, так и на Западе. Кратко и по делу в Telegram. Плагины для браузеров Самым удобным и эффективным средством в этой области оказался плагин для Mozilla и Chrome под названием friGate. Однако, основным языком в сети Tor пока ещё остаётся английский, и всё самое вкусное в этой сети на буржуйском. Ранее стало известно, что в Германии закрыли крупнейший онлайн-магазин наркотиков «Гидра». Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Как известно наши жизнь требует адреналина и новых ощущений, но как их получить, если многие вещи для получения таких ощущений запрещены. Onion - Torxmpp локальный onion jabber. «Завести» его на мобильных платформах заметно сложнее, чем Onion. Возможность создавать псевдонимы. И ждем "Гидру". Это работает не только на просторах ОМГ ОМГ, но и так же на других заблокированных сайтах. Известны под названиями Deepweb, Darknet. Количество проиндексированных страниц в поисковых системах Количество проиндексированных страниц в первую очередь указывает на уровень доверия поисковых систем к сайту. Onion/ - Годнотаба открытый сервис мониторинга годноты в сети TOR. Магазин предлагает несколько способов подачи своего товара. Залетайте пацаны, проверено! Для того чтобы зайти в Даркнет через Browser, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Onion - RetroShare свеженькие сборки ретрошары внутри тора strngbxhwyuu37a3.onion - SecureDrop отправка файлов и записочек журналистам The New Yorker, ну мало ли yz7lpwfhhzcdyc5y.onion - Tor Project Onion спи. Hydra или крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Теперь покупка товара возможна за рубли. Часто ссылки ведут не на маркетплейс, а на мошеннические ресурсы. Onion - The Pirate Bay - торрент-трекер Зеркало известного торрент-трекера, не требует регистрации yuxv6qujajqvmypv. Желающие прочесть его смогут для этого ввести твой публичный ключ, и сервис выдаст текст. Еще есть варианты попасть на основной сайт через зеркала Мега Даркнет, но от этого процедура входа на площадку Даркнет Мега не изменится.

Отзывы бывают и положительными, я больше скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только проверенные, надёжные и четные продавцы. Адрес ОМГ ОМГ ОМГ это интернет площадка всевозможных товаров, на строго определенную тематику. В уголовном кодексе России, в разделе преступления против здоровья населения и общественной нравственности 9 статей, которые определяют степень ответственности лица, причастного к незаконному обороту наркотиков. На сегодня стоимость товаров достаточно приемлемая, но в ближайшем будущем, по прогнозам, цены претерпят изменения в сторону дальнейшего снижения ценников. Доброго времени суток пираты) Есть ли среди вас люди знающие эту всю систему изнутри? Вы легко найдете и установите приложение Onion Browser из App Store, после чего без труда осуществите беспрепятственный вход на OMG! Осторожно! Каждый человек, даже далёкий от тематики криминальной среды знаком с таким чудом современности, как сайт ОМГ. Также обещают исправить Qiwi, Юмани, Web Money, Pay Pal. Сайт вместо Гидры онион похожий по своей тематике. Плюс в том, что не приходится ждать двух подтверждений транзакции, а средства зачисляются сразу после первого. Оставляет за собой право блокировать учетные записи, которые. Какая смазка используется для сальников стиральных машин? Введя капчу, вы сразу же попадете на портал. Омг Вход через Ссылка на Омг - все ссылки. Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Поговорим про наркотики. Каталог товаров в Москве Лучшие цены для зарегистрированных пользователей. Используя это приложение, вы сможете загружать ваши данные на облако. City, Соединённые Штаты Америки, штат Миннесота, Хеннепин-Каунти, город. Личный кабинет абонента МегаФона это контроль финансов, пополнение счёта, подключение и отключение услуг, смена тарифа онлайн, в любой момент без визита в МегаФон. Наркотики станут дороже, криминала на улицах больше. Вместе с процесс покупки станет простым, быстрым и приятным! Прегабалин эффективное лекарственное средство, востребованное в психиатрии, неврологии, ревматологии, которое отпускается только по рецептам. В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Преимущества OMG! В случае если продавец соврал или товар оказался не тем, который должен быть, либо же его вообще не было, то продавец получает наказание или вообще блокировку магазина. Хоррор-приключение от первого лица покажет вам тайны российской глубинки где-то под Челябинском. Rampstroy House, Шоссе Энтузиастов,. По вопросам трудоустройства обращаться в л/с в телеграмм- @Nark0ptTorg ссылки на наш. Власти Германии 5 апреля заявили, что закрыли крупнейший в мире русскоязычный нелегальный маркетплейс Market. Подборка Обменников BetaChange (Telegram) Перейти. Сегодня был кинут на форуме или это уже непонятный магазин Хотел купить. Никогда не употребляйте и даже. Как правильно загрузить фото в?Подробнее. Хорошей недели. Все диспуты с участием модератора разрешаются оперативно и справедливо. Как, какие настройки сделать, как заливать файлы в хранилище. Это позволяет расположить тёмный рынок во владениях данной площадки. Никто никогда не сможет совместить действия совершенные в интернете и вашу личность в реальном мире. Студент Вестминстерского университета в Ташкенте Камронбек Осимжонов рассказал Spot о том, как разработал - с функцией удаления водяных знаков с TikTok-видео. Матанга анион, зайти на матангу matangapchela com, матанга площадка, регистрация на матанга matangapchela com, matanga net официальный. Ramp onion telegram, не удалось войти в систему ramp, фейковый сайт гидры ramppchela com, рамп фейк, рамп не заходит в аккаунт, правильная рамп телеграм. 7/10 (52 голосов) - Search бесплатно.