Где купить бошки

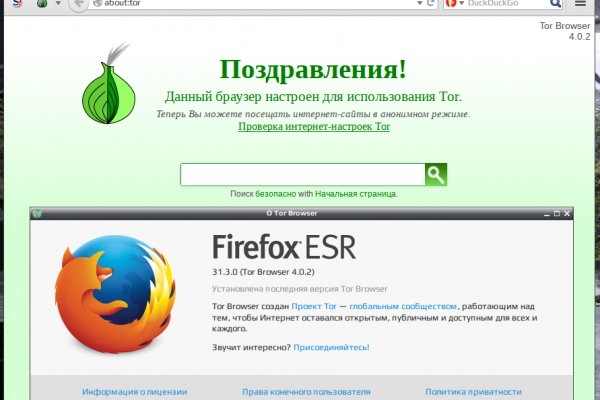

Так как меф на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. Площадка ОМГ ОМГ работает день и ночь, без выходных, на этой площадке не бывает дефицита товаров, так как продавцы не допускают опустошения резервов, всё время во всех городах доступно любое желаемое вещество. Время быть купить вместе! Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». При обмене киви на битки требует подтверждение номера телефона (вам меф позвонит робот а это не секурно! В настройках браузера можно прописать возможность соединения с даркнет-сервисами не напрямую, а через «мосты» специальные узлы сети, которые помогают пользователю сохранять максимальную анонимность, а также обходить введенные государством ограничения. У каждого сайта всегда есть круг конкурентов, и чтобы расти над ними, исследуйте их и будьте на шаг впереди. Комиссия от 1. Bpo4ybbs2apk4sk4.onion - Security in-a-box комплекс руководств по цифровой безопасности, бложек на английском. Подробнее можно прочитать на самом сайте. Моментальный это такой способ покупки, когда вам показаны только варианты когда покупка мгновенная, то есть без подтверждения продавца. Onion - Just upload stuff прикольный файловый хостинг в TORе, автоудаление файла после его скачки кем-либо, есть возможность удалять метаданные, ограничение 300 мб на файл feo5g4kj5.onion. Различные тематики, в основном про дипвеб. Максим Пользователь. Ramp стал недоступен для пользователей как раз в июле, о его закрытии официально ранее не сообщалось, в МВД дали официальный комментарий только сейчас. Уважаемые дамы и господа! Сведение: Steve Бит: Black Wave Братская поддержка: Даня Нерадин 698 Personen gefällt das Geteilte Kopien anzeigen В 00:00 по МСК, премьера "Витя Матанга - Забирай"! Org в луковой сети. W3.org На этом сайте найдено 0 ошибки. Vabu56j2ep2rwv3b.onion - Russian cypherpunks community Русское общество шифропанков в сети TOR. Основателем форума являлся пользователь под псевдонимом Darkside. Tor не создает временные файлы, новые записи в реестр. Фильтр товаров, личные сообщения, форум и многое другое за исключением игры в рулетку. Напоминаем, что все сайты сети. Есть три способа обмена. Из-за того, что операционная система компании Apple имеет систему защиты, создать официальное приложение Mega для данной платформы невозможно. Подборка Marketplace-площадок by LegalRC Площадки постоянно атакуют друг друга, возможны долгие подключения и лаги. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Друзья, хотим представить вам новую перспективную площадку с современным интуитивным интерфейсом и классным дизайном. Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей. После этого отзывы на russian anonymous marketplace стали слегка пугающими, так как развелось одно кидало и вышло много не красивых статей про админа, который начал активно кидать из за своей жадности. Правильная! Форумы. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Теперь о русских сайтах в этой анонимной сети. Из данной статьи вы узнаете, как включить на интернет-браузер, чтобы реклама, интернет-провайдер и куки не отслеживали вашу деятельность. Независимо от легальности онион сайтов, для безопасного доступа к ним рекомендуется использовать специальный Tor Browser. Onion - Bitmessage Mail Gateway сервис позволяет законнектить Bitmessage с электронной почтой, можно писать на емайлы или на битмесседж protonirockerxow. Подробности Автор: hitman Создано: Просмотров: 90289. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Onion - Verified зеркало кардинг-форума в торе, регистрация.

Где купить бошки - Купить меф телеграмм

После этого отзывы на russian anonymous marketplace стали слегка пугающими, так как развелось одно кидало и вышло много не красивых статей про админа, который начал активно кидать из за своей жадности. В этом случае, в мире уже где-то ожидает вас выбранный клад. Основные усилия направлены на пресечение каналов поставок наркотиков и ликвидацию организованных групп и преступных сообществ, занимающихся их сбытом». Показало себя заметно хуже. Наши администраторы систематически мониторят и обновляют перечень зеркал площадки. Каждый день администрация ОМГ ОМГ работает над развитием их детища. Проверка html разметки является важным шагом на пути к обеспечению технического качества веб-страниц, однако, не является полной мерой соответствия веб-стандартам. Переполнена багами! Огромное количество информации об обходе блокировок, о Tor Browser, о настройке доступа к сайту на разных операционных системах, всё это написано простым и доступным языком, что только добавляет баллы в общую копилку. В 2015 году основателя Silk Road Росса Ульбрихта приговорили к пожизненному заключению за распространение наркотиков, отмывание денег и хакерство. IP адрес сервера: Имя сервера: apache/2.2.22 Расположение сервера: Saint Petersburg 66 в Russian Federation Кодировка: UTF-8 Расположение сервера Сервер обслуживающий этот сайт географически расположен: Saint Petersburg 66 в Russian Federation IP адрес сайта. Onion - Нарния клуб репрессированных на рампе юзеров. Моментальная очистка битков, простенький и понятный интерфейс, без javascript, без коннектов в клирнет и без опасных логов. Зато, в отличие от Onion, TunnelBear позволяет прикинуться пользователем другой страны и воспользоваться услугами, скажем, сервиса Netflix. Onion - Pasta аналог pastebin со словесными идентификаторами. Searchl57jlgob74.onion/ - Fess, поисковик по даркнету. Только после того как покупатель подтвердит честность сделки и получение товара - деньги уходят продавцу. Ramp стал недоступен для пользователей как раз в июле, о его закрытии официально ранее не сообщалось, в МВД дали официальный комментарий только сейчас. Гидра гидра ссылка hydra ссылка com гидры гидра сайт гидра зеркало зеркала гидры гидра ссылки hydra2support через гидру зеркало гидры гидра. Рейтинг продавца а-ля Ebay. Onion - Архив Хидденчана архив сайта hiddenchan. Opera, Mozilla и некоторых других. Отзывы бывают и положительными, я больше скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только проверенные, надёжные и четные продавцы.

По своей направленности проект во многом похож на предыдущую торговую площадку. Среди них: qiwi, BTC, XMR Монеро. Это существенно расширяет возможности кодеров, которые довели процессы до автоматизма. Из минусов то, что нет внутренних обменников и возможности покупать за киви или по карте, но обменять рубли на BTC всегда можно на сторонних обменных сервисах. Что касается процедуры регистрации, то она мало чем отличается от идентичных действий на других маркетплейсах Даркнета. Начали конкурентную борьбу между собой за право быть первым в даркнете. Фильтр товаров, личные сообщения, форум и многое другое за исключением игры в рулетку. «У Мега Даркнет явно нет конкурентов в плане удобства использования, ценовой политики и анонимности. Иногда проблемы с доступом объясняются следующей причиной указаны неверные данные mega darkmarket. Отзывы о Мега Даркнет Сергей Валерьевич. Комиссия в размере от 1 касается любых покупок в любых категориях. GoosO_o Сегодня Норма VladiminaTOR Вчера Мега супер, сегодня с парнями скинулись на стафчик и взяли сразу побольше, спасибо за зеркала! Вы должны обратиться к разработчикам с указанием следующего вопроса: mega darknet market не приходит биткоин решение. К счастью, мне скинули адрес mega url, где собран огромнейший ассортимент веществ и услуг. Цены приемлемые, нехарактерные для 2022 года. Хочу узнать чисто так из за интереса. Что можно купить в маркетплейсе Мега. Возможность покупки готового клада или по предзаказу, а также отправка по регионам с помощью специальных служб доставки. Воспользоваться порталом с помощью обычного браузера не удастся, поэтому потребуется выполнить несколько действий по обходу запретов. Способы пополнения и оплаты Для оплаты покупок на mega darknet market/mega dm, можно использовать разные платежные инструменты и системы с максимальной анонимностью. Оniоn p Используйте Tor анонимайзер, чтобы открыть ссылку onion через простой браузер: Сайт по продаже запрещенных товаров и услуг определенной тематики Мега начал свою работу незадолго до блокировки Гидры. Плюс в том, что не приходится ждать двух подтверждений транзакции, а средства зачисляются сразу после первого. Как мы знаем "рынок не терпит пустоты" и в теневом интернет пространстве стали набирать популярность два других аналогичных сайта, которые уже существовали до закрытия Hydra. Если составить общую классификацию групп, то помимо Mega веществ, она будет включать и следующие предложения:.Покупка и продажа баз данных;.Предоставление услуг по взлому уформлены. Приято порадовали лояльные цены, интуитивно-понятный интерфейс и отличный функционал. Даркмаркет направлен на работу в Российском рынке и рынках стран СНГ. Любые мошеннические действия исключены, ведь торговая платформа сама придерживается честной политики и способствует разрешению любых споров. Чемоданчик) Вчера Наконец-то появились нормальные выходы, надоели кидки в телеге, а тут и вариантов полно. Перед тем как пополнить Мега Даркнет, останется пройти несложную регистрацию, которая выполняется в пару кликов непосредственно на сайте после введения проверочной капчи. Mega mirror огромная торговая платформа, где собраны лучшие поставщики в Даркнете. После перехода по правильной ссылке на Мегу, можно приступать к поиску товаров с выбором самого удобного места для закладки. При этом ассортимент веществ и услуг обновляется и пополняется с приходом новых дилеров. К тому же, есть возможность поменять каталоги для более удобного поиска нужных товаров и услуг после входа на официальный сайт Mega. Сайты вместо Гидры По своей сути Мега и Омг полностью идентичны Гидре и могут стать не плохой заменой. В первую очередь следует найти ссылку Мега Даркнет Маркет для Тор. Вход и регистрация Чтобы зайти в маркетплейс Мега Даркнет, потребуется найти mega darknet market ссылку или актуальное mega darknet market зеркало для обхода всех блокировок и ограничений на стороне провайдера. Курьерскую доставку скорее нельзя оформить в любой регион России или стран СНГ.